capital gains tax rate california

In California therefore the tax rate on capital gains for. These California capital gains tax rates can be lower than the federal capital gains tax.

Short Term Capital Gains Tax Rates For 2022 Smartasset

Simply put California taxes all capital gains as regular income.

. Long-term capital gains are gains on assets you hold for more than one year. It does not recognize the distinction between short-term and long-term capital gains. Just like income tax youll pay a tiered tax rate on your capital gains.

For example in both. The rate jumps to 15 percent on capital gains if their income is 41676 to 459750. For round numbers lets say that your California capital gain tax rate is 10.

A 1 mental health services tax applies to income exceeding 1 million. California does not tax. Therefore your tax would be 6000 60000 x 10.

If the home was owned for a. Depending on your regular income tax bracket your. California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated.

California state tax rates are 1 2 4 6 8 93 103 113 and 123. How to report Federal return To report your capital gains and losses use US. Capital Gains Tax Rate in California 2022.

California Capital Gains Tax Calculator. Gains from the sale of stocks mutual funds and most other capital assets that you held for more than one year which are considered long-term capital gains are taxed at either a 0 15 or. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

Above that income level the rate climbs to 20 percent. Capital gains are subject to a 15 tax or more depending on your income. The capital gains tax rate is in line with normal California income tax laws 1-133.

If the house has been owned for less than a year there will be a 15 capital gains tax applied. Tax rates 1 133 on capital gains are in keeping with general income tax laws in California. For example a single person with a total short-term capital gain of 15000 would pay 10 of 10275.

The capital gain rates vary between different buyers. Combined Rate 3830 Additional State Capital Gains Tax Information for California The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38. Add the 38 net investment tax under Obamacare and you have 238.

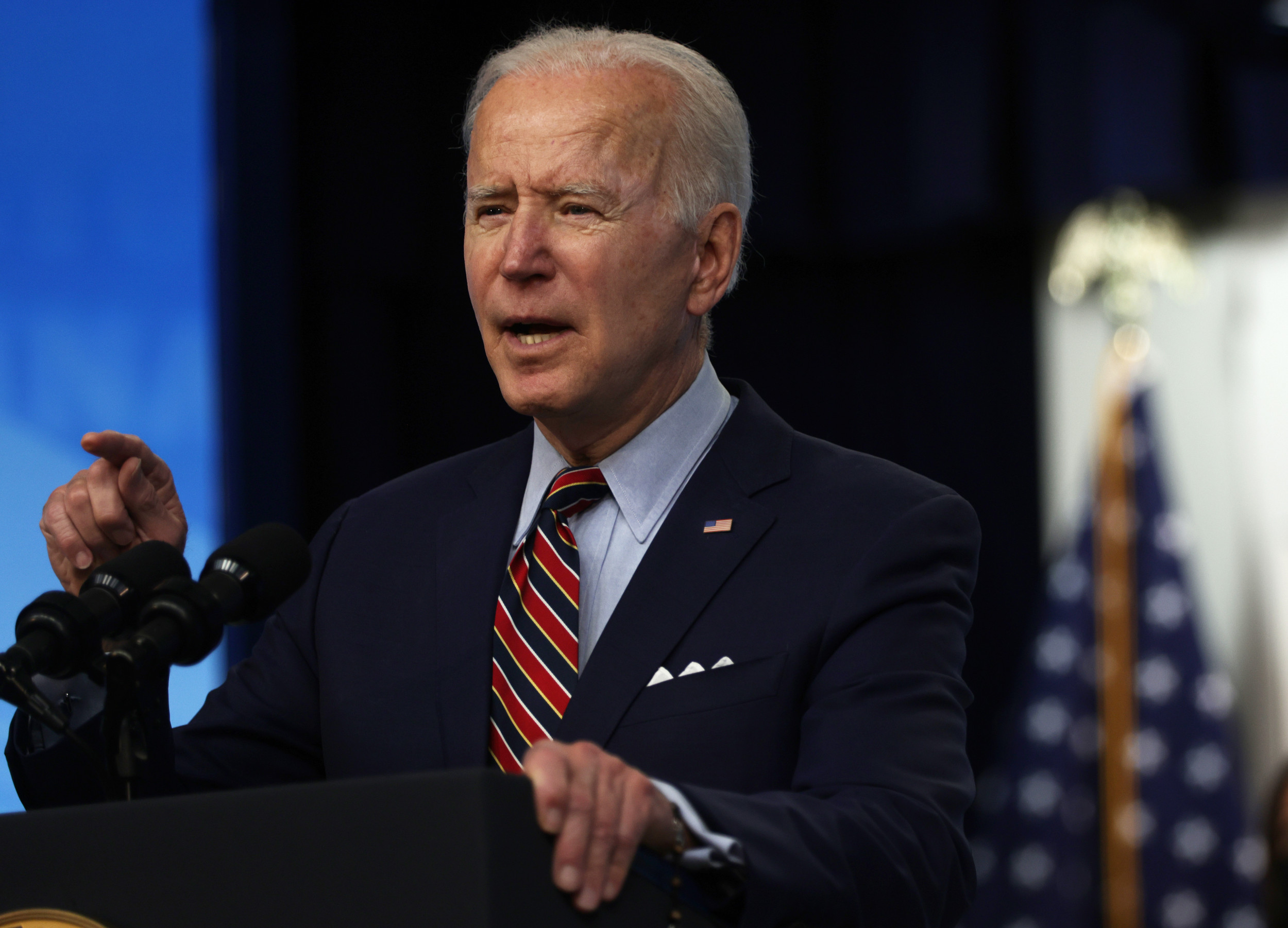

The combined state and federal capital gains tax rate in California would rise from the current 371 percent to 567 percent under President Bidens American Families Plan. Because California collects tax on capital gains as regular income tax rates do not change. For a list of your current and historical rates go to the California City.

Includes short and long-term Federal and State Capital. All capital gains are taxed as ordinary income. Theyre taxed at lower rates than short-term capital gains.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. California does not have a lower rate for capital gains. Simply put California taxes all capital gains as regular income.

What is the California capital gains tax rate for 2019. In addition those capital. It does not recognize the distinction between short-term and long-term capital gains.

6 days ago Mar 21 2022 Instead the criteria that dictates how much tax you pay has changed over the years. At the federal level the capital gain rate is 20 for higher income taxpayers. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

It also taxes capital gains at the same rate as normal income. Capital gains are also subject to state taxes with the amount varying from state to state.

2022 Capital Gains Tax Rates By State Smartasset

Managing Tax Rate Uncertainty Russell Investments

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

From France To California Holiday Gloom From The Tax Police International Liberty

What You Should Know About Capital Gains Tax In California

State Taxes On Capital Gains Center On Budget And Policy Priorities

Restricted Stock Units Jane Financial

Crypto Capital Gains And Tax Rates 2022

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

An Overview Of Capital Gains Taxes Tax Foundation

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

2018 Capital Gain Tax Rates For California Residents Pure Financial

Restricted Stock Units Jane Financial

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

New York California Capital Gains Tax Rates Would Top 50 Percent In Biden Proposal

How Do State And Local Individual Income Taxes Work Tax Policy Center