do you have to pay taxes when you sell a used car

For example if you bought the two-year-old SUV for the original retail price of. You do not need to pay sales tax when you are selling the vehicle.

Selling a car for more than you have invested in it is considered a capital gain.

. Whether you have to pay taxes on the sale of your car mainly depends on how much you sell it for. When you sell a car for more than it is worth you do have to pay taxes. However you will not pay.

Its very unusual for a used car sale to be a taxable event. If you sell a used car for less than its original purchase price plus any. So if your used vehicle costs 20000 and you live in a state that charges a 6 sales tax the sales tax will raise your cars purchase price to 21200 excluding any additional.

If you purchase a car in one state and then move to another you might still have to pay taxes. A taxable gain occurs when something sells for more than its cost basis. For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit.

Ad Well Buy Your Car You Dont Have to Buy One From Us. Thankfully the solution to this dilemma is pretty simple. Unless its part of negotiations the buyer will be required to pay all applicable fees and taxes to local.

You likely paid a considerable amount of. The car sales tax is based on the state where you will register your vehicle so you will have to pay only the sales tax of the state you live in. However you wont need to pay the tax.

Have Your Car Appraised Online See How Much Its Worth. However if you purchase your vehicle 90. Traditionally the buyer of a car is the one concerned about paying taxes.

Thus you have to pay. On the other hand if you are a buyer and decide to purchase a used car you will have to pay sales taxes because you are becoming an owner of something valuable. Even in the unlikely event that you sell your private car for more than you paid for it special.

The buyer is responsible for paying the sales tax. When it comes time to calculate your total income to report on your 1040 form you need to include all the money youve been paid. Answered by Edmund King AA President You dont have to pay any taxes when you sell a private car.

Answer 1 of 5. You can determine the amount you are about to pay based on the Indiana excise tax table. Most car sales involve a vehicle that you bought new and are.

Do I Have to Pay Sales Tax on a Car When I Move. Ad Get A Free Quote For Your Used Car - Find Your Car Value By VIN or Model Year. In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot.

Used cars are not taxed in Alaska. Does that include money you earned selling.

Car Bill Of Sale Pdf Bill Of Sale Car Cars For Sale Used Bill Of Sale Template

Texas Car Sales Tax Everything You Need To Know

Vintage 1960s English Ford Auto Print Ad Etsy In 2022 Classic Cars British Ford Ford Anglia

Nj Car Sales Tax Everything You Need To Know

Don T Get Caught In Any Of These Traps When Buying A Car Car Prices Car Buying Car

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

Cars For Sale In Greer Sc Cheap Used Cars For Sale Happy Auto

Virginia Sales Tax On Cars Everything You Need To Know

:max_bytes(150000):strip_icc()/Just-what-factors-value-your-used-car_round2-debecdd740064e55b77979a734920925.png)

Just What Factors Into The Value Of Your Used Car

Fillable Form Vehicle Bill Of Sale Bills Things To Sell Types Of Sales

Download Blank Bill Of Sale Bill Of Sale Car Bill Of Sale Template Old Used Cars

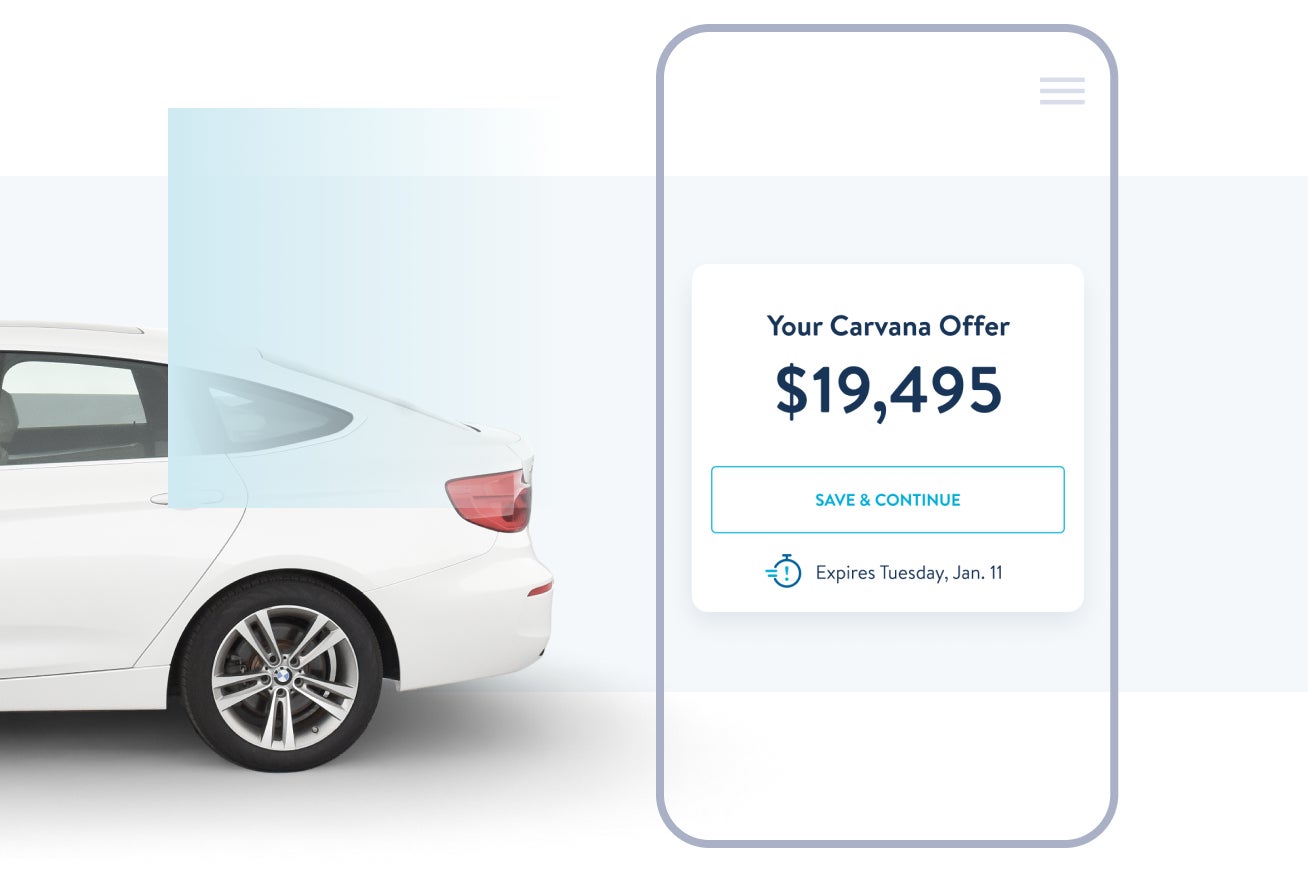

Selling Or Trading In Your Car To Carvana How It Works Carvana

Cars For Sale In Greer Sc Cheap Used Cars For Sale Happy Auto

Car Dealers Melbourne Autoline Car Sales Cars For Sale Car Dealer Best Car Deals

Find Your Next Used Vehicle Here Ford Escape Used Suv 2017 Ford Escape

Why Should One Have To Pay Taxes On Used Car Driving Instructor Sell Car Wedding Photo Booth Props

/GettyImages-160143914-490a0fd99380456fb809d575104c4719.jpg)